Trading in the Know News letter

One of the most common errors traders make is trading without a plan.

It is recommended to have a written trading plan for two reasons. Firstly, trading involves various factors like market conditions, overseas market status, and index futures. Analyzing index futures can assist in analyzing overall market conditions. To minimize risk and avoid losses, traders should create a to-do list and research the market before making any decisions. This will help them make informed decisions based on market analysis.

Over-leveraging is the second mistake traders make. It might be useful during a winning streak, but it can quickly become the biggest enemy when trends shift. It's crucial to determine the percentage of your account you're willing to risk on each trade setup and then divide that by the stop loss you intend to set based on that setup to determine your lot size. Over-leveraging can lead to quick losses of all your money.

Many traders have a bullish or bearish bias, leading them to take unnecessary risks. Traders may not realize they are in a losing position until it has accumulated into a significant loss due to their own biases. Objectivity is essential for successful trading, but it is also challenging to master. Inattentional blindness can be harmful in trading.

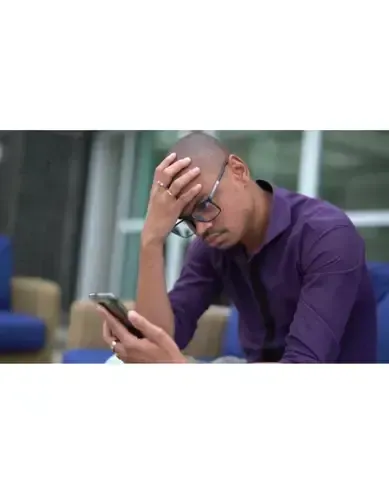

Finally, trading in financial markets can be compared to entering a battlefield. It is essential to be emotionally and psychologically prepared before trading. A calm, positive attitude towards trading is paramount. Being angry, preoccupied, or hung-over can lead to losses. Therefore, it is crucial to be completely relaxed before entering the market, and traders may engage in meditative routines or other activities to promote relaxation. By avoiding these four common mistakes, traders can increase their chances of success.